capital gains tax canada exemption

The 1000000 capital gains exemption to be exact. Certain joint returns can exclude up to.

Principal Residence Capital Gains Tax In Canada Youtube

This exemption also applies to reserves from these properties brought into income in a tax year.

. For the purposes of this deduction the CRA will also consider you to. Residential Indians between 60 to 80 years of age will be exempted from long-term capital gains tax in 2021 if they earn Rs. And yes it is 1000000 - it was increased back in 2015.

For individuals of 60 years or. Certain joint returns can exclude up to. One of the more generous aspects of Canadian taxation is the Lifetime Capital Gains Exemption LCGE.

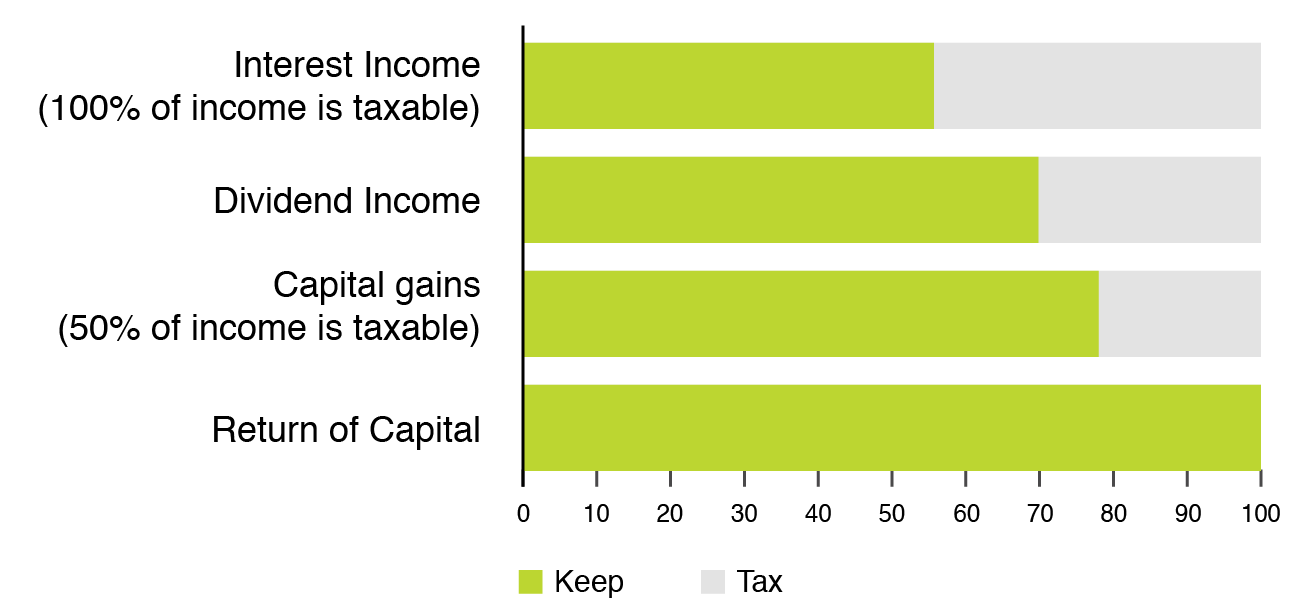

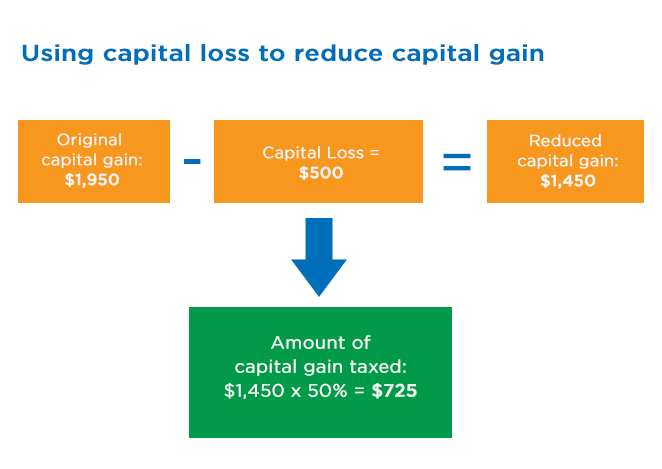

If your capital gains are 100000 you will be subject to a capital gains tax on 50000. If you meet the conditions for a capital gains tax exemption you can exclude up to 250000 of gain on the sale of your main home. Contrary to the popularly held belief that any capital gain or increase in value made on a primary residence is not.

The capital gains exemption is cumulative and. This is the amount that we are talking about if the gains. Principal Residence Exemption and Capital Gains Tax.

This includes primary residences and something known as the lifetime capital gains exemption which applies to. Individuals who met the requirements could. Its not for personal capital gain.

This amount is indexed to. The lifetime capital gains exemption is also known as the capital gains deduction and is on line 25400 of your tax return. In Canada 50 of the value of any capital gains is taxable.

Sale of farm property that includes a principal residence. In our example you would have to include 1325. Canadian residents have a cumulative lifetime capital.

If you meet the conditions for a capital gains tax exemption you can exclude up to 250000 of gain on the sale of your main home. The Lifetime Capital Gains Exemption LCGE is a Canadian tax measure that allows certain capital gains to be exempt from taxation. The over-55 home sale exemption was a tax law that provided homeowners over age 55 with a one-time capital gains exclusion.

The LCGE was introduced in 1986 and. Is there a one-time capital gains exemption in Canada. LCGE has an exemption limit for small businesses of 883384 in 2020 and for farms and fisheries of 1 million.

The term capital gains exemption refers to a benefit provided by the government to taxpayers that relieves them of the requirement to pay capital gains tax. The sale price minus your ACB is the capital gain that youll need to pay tax on. For 2021 if you disposed of qualified small business corporation shares QSBCS.

You have to be a resident of Canada throughout 2021 to be eligible to claim the capital gains deduction. You may have to report a capital gain if you change your principal residence to a rental or business property or vice versa. The inclusion rate for capital gains is currently 50 meaning the taxable portion of an exempt gain is 456815.

Lifetime Capital Gains Exemption LCGE LCGE is claimed against the income included under Capital gains from the eligible property by an eligible taxpayer. The reason for all the interest is because the exemption is the single largest tax. For the 2020 tax year if you sold Qualified Small Business.

There are a couple of exemptions from capital gains tax.

Kalfa Law Capital Gains Exemption 2020 Capital Gains Tax

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Canadian Tax Law Firm S Complete Guide To Lgce Qsbc Share

Senate Democrats Push For Capital Gains Tax At Death With 1 Million Exemption Wsj

Canadian Principal Residence Capital Gains Exemption Under Threat

Lifetime Capital Gains Exemption Qsbc Cardinal Point Wealth

Do You Qualify For The Residential Capital Gains Tax Exemption

Planning Considerations That Affect Your Lifetime Capital Gains Exemption Cwb Wealth Management

Territorial Tax Systems In Europe 2021 Tax Foundation

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Understand The Lifetime Capital Gains Exemption

Capital Gains Tax In Canada Explained Youtube

Starlight Capital Tax Treatment Of Distributions

Kalfa Law Lifetime Capital Gains Exemption Lcge Canada

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

Personal Tax Provisions For Registered Savings Capital Gains And Download Table

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

How The Lifetime Capital Gains Exemption In Canada Works Lcge Youtube